Are American Eagle Gold Coins a Good Investment?

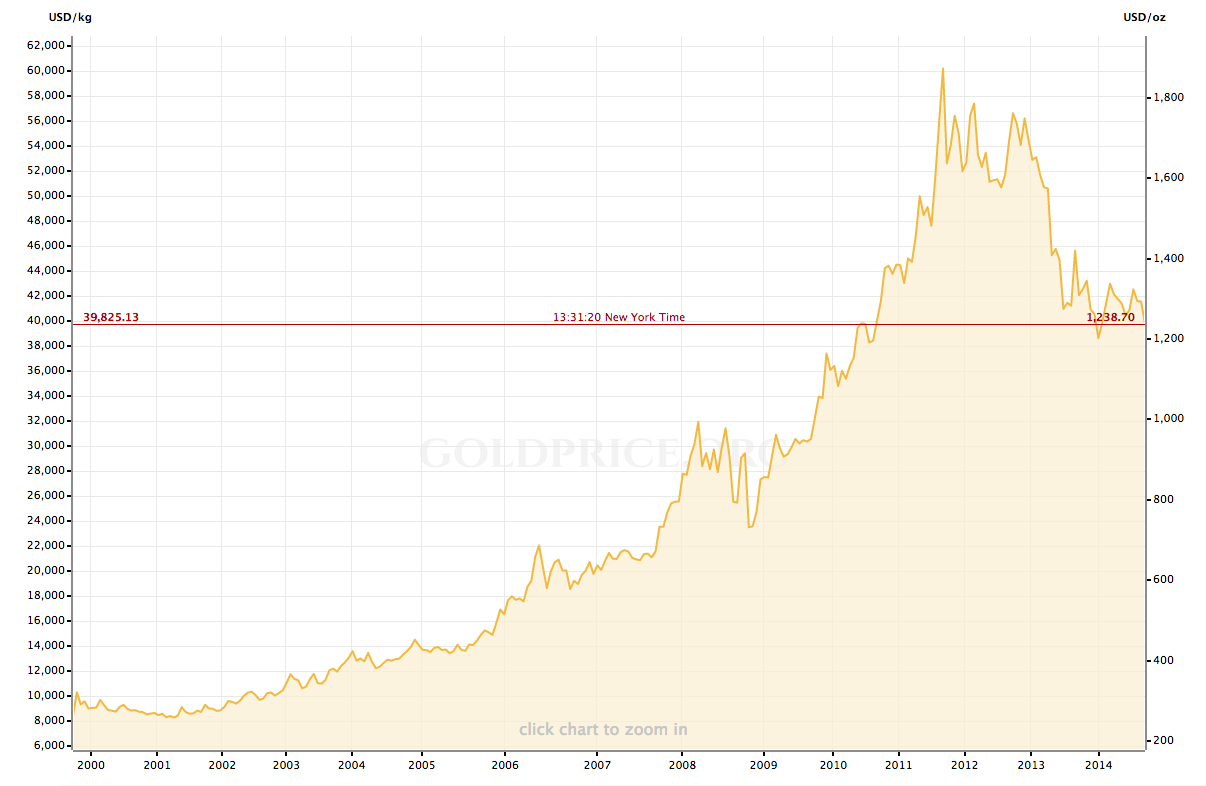

Investors traditionally choose gold for the stability, liquidity, and diversification it adds to their investment portfolio. There are many ways to invest in physical gold. Experienced investors and industry experts agree that purchasing certain IRA-eligible gold coins is one of the safest ways to add gold to your overall investment portfolio. One of the best gold coin investments is the American Eagle Gold. Gold Eagle Coin History The American Gold Eagle coin first appeared in 1986 and quickly became one of the country’s most prominent... Continue Reading

Category | Gold