Gold IRA Rollover: What It Is and How to Do One

One of investors’ biggest questions when considering investing in gold through a Gold IRA is how to best fund that investment. While it is possible to use your current on-hand cash to purchase gold or other precious metals for a Gold IRA, you may lose out on some of the tax advantages of IRA investment.

In some situations, a financial advisor might suggest taking current retirement assets from a 401(k) or other IRA and using those funds to purchase your gold. This is often called a Gold IRA rollover and can be a powerful tool for preserving tax-advantaged funds.

Let’s walk through the basics of this type of rollover and how Advantage Gold can help you use those newly available funds to purchase gold and precious metals that will diversify your portfolio.

What is a Gold IRA Rollover?

A Gold IRA rollover occurs when you convert 401(k) or similar accounts, tax-free and penalty-free, into the type of individual retirement account that allows ownership of physical gold within the plan.

A Gold IRA is self-directed. You choose the exact allowable instruments you’d like to invest in within the rules of the IRA. This differs from traditional 401(k) plans employers offer or sponsor. You generally have little say in what the 401(k) is invested in and typically only get to choose your level of risk, sectors that you’re interested in investing in, and the percentage of allocation into those sectors. You end up owning a basket of stocks in your chosen sectors but not much else.

As a Gold IRA investor, you can own physical, IRA-eligible gold coins or physical gold bars as a significant part of your portfolio. You can mix and match your gold with stocks and other paper-based assets. If you choose to invest only in your precious gold, that’s fully allowable, too. It’s your choice.

What’s the Difference Between a Gold IRA Rollover and a Gold IRA Transfer?

A Gold IRA rollover differs from a Gold IRA transfer in that a rollover moves funds from one type of plan (401(k)) to a different kind of plan (IRA). A transfer moves funds from one type of plan (IRA) to the same sort of plan (IRA).

Even though different custodians may administer the two IRA plans, they still have the same rules.

Benefits of Rolling Over Funds Into a Gold IRA

Without knowing your individual circumstances, we can’t tell you for certain that you should roll over funds into a Gold IRA, but we can certainly share why some investors are rushing to get their funds rolled over. Many investors want to:

- Gain control of their investment portfolio.

- Lower their fees.

- Open up a wider array of investment options.

- Stay invested and tax-deferred while avoiding withdrawal fees and penalties.

Control

Many investors feel helpless and stuck with their 401(k) plan. They don’t know who manages it, why it is invested in a specific manner, or the motives of the controlling parties. After reaching the age of 59 ½, when there is no longer a withdrawal penalty, or when an eligibility opportunity like separation of employment occurs, investors often jump at the chance to regain control of their hard-earned money. Many choose the Gold IRA because it offers choice and control.

Lower Fees

Exorbitant fees are often associated with 401(k) accounts. Because this type of plan is managed—typically by a big Wall Street investment firm—it may incur many fees that can eat away at your investment growth and savings.

Management, trading, and annual fees are just a few fees a 401(k) must satisfy. A Gold IRA typically has one yearly fee, which includes all administrative costs, paperwork costs, and even the expenses of safely and securely storing and insuring your gold in some of the world’s greatest depositories (vaults).

More Investment Options

Because a Gold IRA is self-directed, you have complete control over what you want to own and how much. You want to own gold coins and only gold coins? No problem. Like the famous fast food restaurant says: Have it your way. Keep in mind that Advantage Gold is not a financial advisor and we cannot give any stock recommendations – we can simply help up the self-directed IRA and you decide how much you wish to allocate into which asset.

Stay Tax Deferred and Penalty Free

Just because you’ve left a job, it doesn’t mean that your money has to stay tied to the employer’s 401(k) plan. If you have separated from your previous employer, you have the right to keep your investment funds tax deferred and penalty free by rolling them into a new Gold IRA. You will gain control without losing any advantages that a tax-deferred retirement account offers.

How To Roll Over An IRA or 401(k) Into a Gold IRA

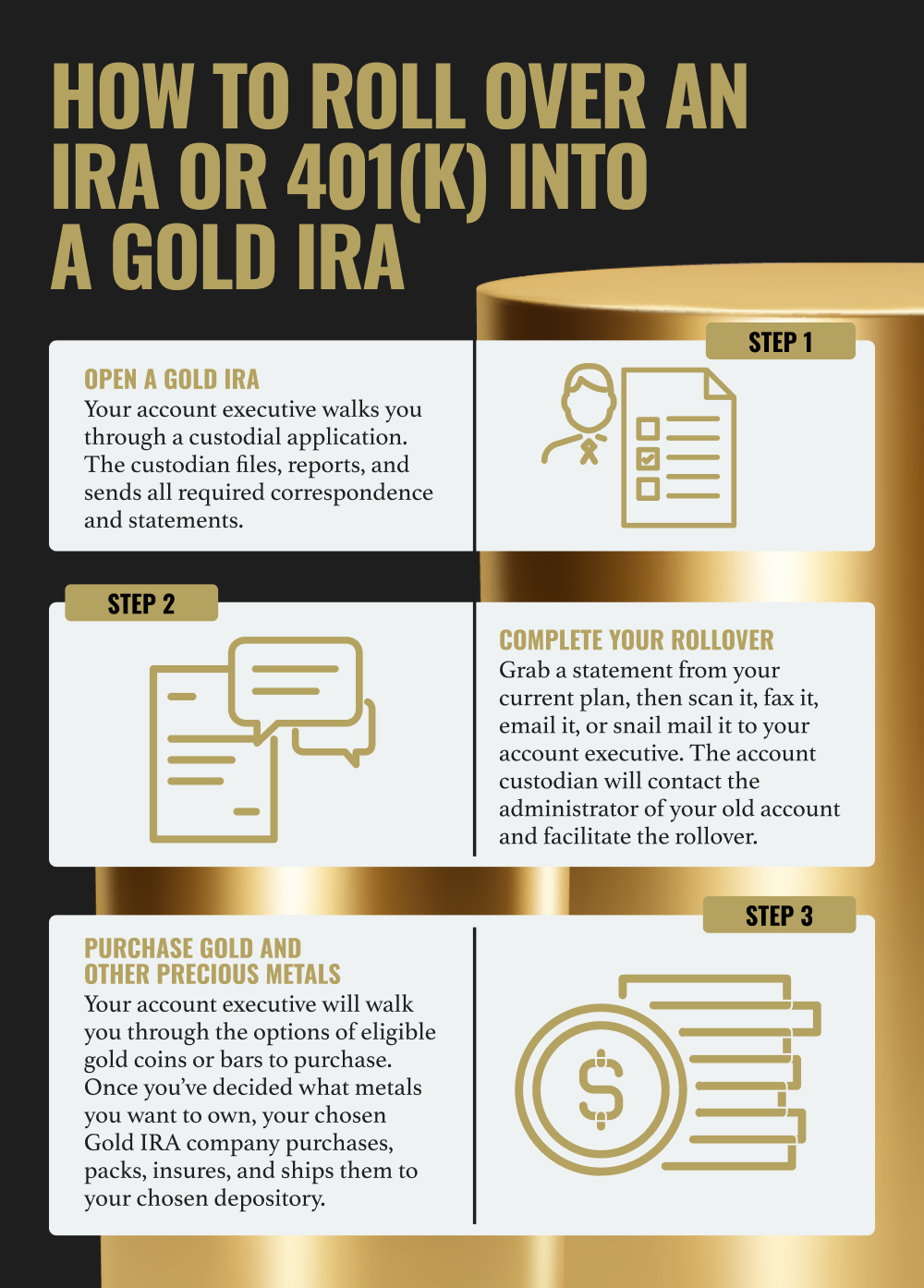

You asked, what is a Gold IRA? Hopefully, by now, you have a clear understanding. You’ve decided that you want physical gold as part of your portfolio, you’ve digested this 401(k) to Gold IRA rollover guide, and you’re ready to get started. What’s next? Well, the good news is that rolling over an existing account into a Gold IRA is easy and can be completed in just a few simple steps:

- Open a Gold IRA.

- Complete your rollover.

- Purchase your gold and other precious metals.

1. Open a Gold IRA

This process is quick and painless. Your account executive will walk you through the custodial application, making sure to “dot the I’s and cross the T’s.” The custodian “hosts” your account and files, reports, and sends all required correspondence and statements. You are never responsible for these tasks, as the custodian does them for you. The required application information is straightforward and typically easy to find.

Once you complete a few forms and e-signatures, you will be the proud new owner of a Gold IRA account.

2. Complete Your Rollover

Grab a statement from your current plan, then scan it, fax it, email it, or snail mail it to your account executive. Now you can sit back and relax. The executive will forward the statement to the custodian. The account custodian will contact the administrator of your old account and facilitate the rollover.

Yes, it is that simple.

In a few days, your new account will be funded. Remember, if you had $100,000 in your old account, you would have $100,000 in the new account. There are no taxes or penalties to facilitate the Gold IRA rollover.

3. Purchase Gold and Other Precious Metals

Once you’ve funded your account, your account executive will walk you through the options of eligible gold coins or bars. They can also advise you on any other precious metals allowed in the Gold IRA.

The IRS provides stringent guidelines on the quality, purity, and condition of the metals that you will hold inside your retirement plan:

- Gold must be 99.5% pure.

- Coins must come from approved government mints and remain uncirculated. They must also be in perfect physical condition.

- Bars must match the same purity standard and can only be sourced from approved manufacturers.

Once you’ve decided what metals you want to own, your chosen Gold IRA company purchases, packs, insures, and ships them to your chosen depository.

The IRS regulates all approved depositories, which must meet stringent space, storage, security, administration, and reporting guidelines. The available depositories include some of the most renowned vaults in the world, such as the Delaware Depository, Brinks, JPMorgan, and HSBC Bank.

Upon their arrival, the depository will carefully inspect your metals to ensure they adhere to IRS standards and confirm that they are what they are supposed to be.

Your metals then go into your custodian’s section of the vault, where they sit safe and sound until you visit them at the depository or request physical distribution and have your metals sent to you.

Are There Fees Associated With a Gold IRA Rollover?

A fee is associated with a Gold IRA rollover, but the good news is that most find that the annual custodial fee is nominal, especially for all it covers.

The small annual custodial fee covers everything that is entailed with a Gold IRA, including:

- Plan administration

- Reporting

- Statements

- Insured storage of metals

Are You Ready To Do a Gold IRA Rollover?

You’re in good company. Since the Taxpayer Relief Act of 1997 broadened the types of investments allowed in an IRA, scores of investors have rushed to the Gold IRA rollover to own a tangible asset, gain control of their portfolio, lower their fees, and increase their investment options, all while staying in a tax-deferred and penalty-free status.

Advantage Gold has been educating and helping investors like you for the last decade. We are experts who love what we do. Contact us today, and let us show you how easy it is to get started with your Gold IRA rollover. We’re happy to help.