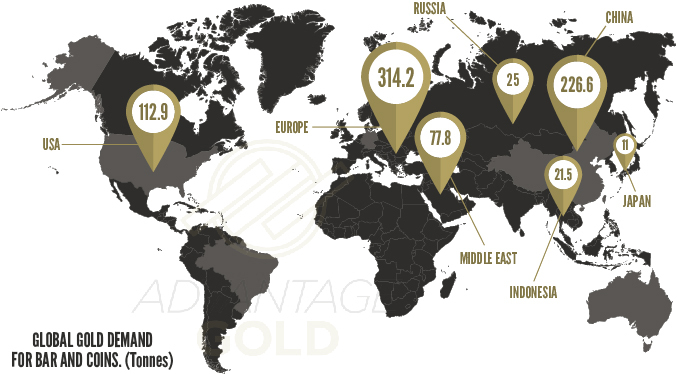

Global Demand

Gold has been viewed as a way to pass on and preserve wealth from one generation to the next, especially because of global demand. This global demand has been driven by numerous factors including but not limited to the Great Financial Crises, inflation, central bank activities, central bank demand, and more. According to The World Gold Council, the amount of gold bought annually has roughly tripled since the 1970s. The demand for gold is unlikely to weaken anytime soon. Central banks have been buying gold like gangbusters in recent years. With global central banks trying to unwind their years of ultra-low interest rates and quantitative easing, the need for gold is greater now than ever, setting a new record high of up 152% to 1,136t in 2022.