Inflation

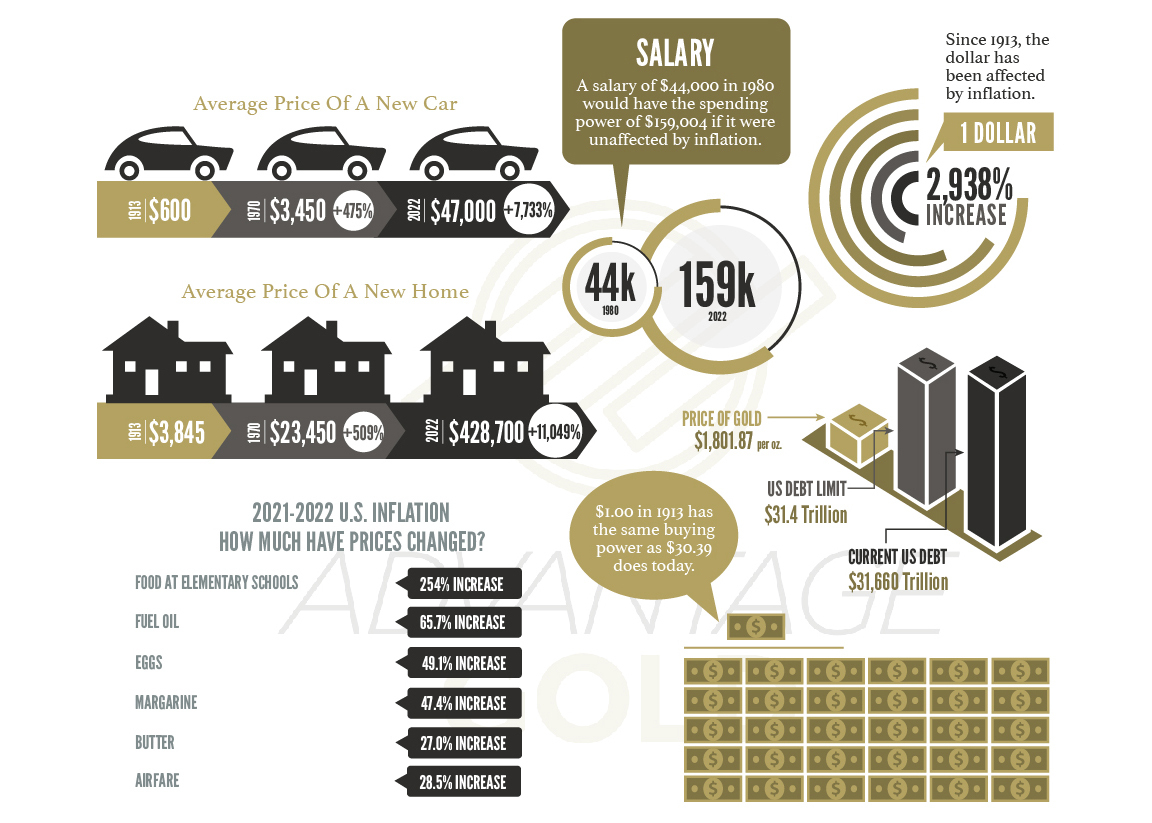

Inflation has been a significant concern in the United States over the past five years. The Consumer Price Index (CPI), which measures the average change in prices for goods and services, has risen by 6.2% over the past 12 months, the highest rate of inflation in over 30 years. Rising prices for goods and services have put a strain on households, particularly those on fixed incomes or with lower incomes, who are more vulnerable to the effects of inflation. In addition, higher inflation can lead to higher borrowing costs, which can put a strain on businesses and lead to lower investment and hiring.

The COVID-19 pandemic has contributed to inflationary pressures in the United States. Supply chain disruptions and shortages of key goods, such as semiconductors and building materials, have driven up prices for everything from cars to housing. In addition, large-scale government stimulus programs, including direct payments to households, have injected more money into the economy, contributing to higher prices for goods and services.

While these programs have provided critical support for households and businesses during the pandemic, there are concerns that they could contribute to longer-term inflationary pressures.

Addressing the challenge of inflation in the United States will require a careful balancing act by policymakers. On the one hand, policymakers will need to continue to provide support to households and businesses as they recover from the pandemic. On the other hand, they will need to take steps to ensure that inflation remains under control and does not threaten the broader economy. This may involve tightening monetary policy, including raising interest rates, as well as measures to address supply chain disruptions and other factors driving up prices. Ultimately, the goal will be to strike a balance between supporting economic growth and ensuring that inflation remains under control.