How Much Does a Gold IRA Cost

No matter how you plan to save for retirement, you’re probably thinking about the overall costs. Even traditional 401(k)s and IRAs typically have some form of fees or management costs. And as the banking system proves to be more volatile than ever—including the risk of loss due to recession or market instability—you might be considering alternative means of investing, including in precious metals like silver or gold. One way to pursue gold or silver as an investment is through a Gold IRA.

While Gold IRAs are a fantastic self-directed investment option, they’re not a way to dodge those costs. Before you invest in a Gold IRA, it’s always wise to talk to a financial advisor and consider any extraneous fees from setup to maintenance.

What is a Gold IRA?

A Gold IRA is a self-directed individual retirement account allowing the investor to buy physical gold or other precious metals, such as silver, platinum, or palladium. It’s different from traditional IRAs, which primarily include stocks, bonds, or mutual funds.

Gold IRAs are an excellent way for investors to diversify their portfolios to hedge against inflation and other unfavorable economic conditions. When you invest in a Gold IRA, your gold or precious metals are kept in custody at an approved depository. In addition, the precious metals in Gold IRAs must meet specific fineness requirements for eligibility.

How Much Does It Cost to Start a Gold IRA?

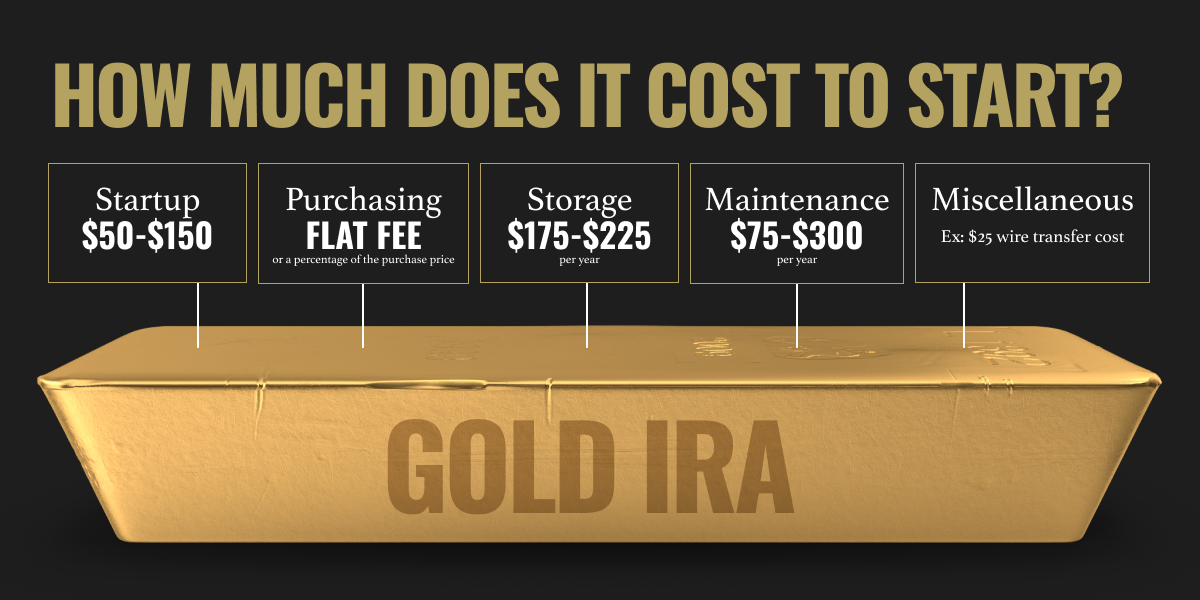

Opening a Gold IRA can cost an average of $100 to $300, not counting the funds you use to purchase the gold. It also doesn’t factor in storage costs or insurance for your gold. Instead, the initial prices typically include one-time account creation costs and a yearly administrative fee. Each one averages between $50 and $150.

Additional Gold IRA Startup Costs and Fees

The initial setup costs aren’t the only ones you’ll need to consider. Because Gold IRAs are subject to additional government regulations on purchasing, storage, and maintenance, there are associated fees to consider.

Purchasing Fees

Because gold and other precious metals are tangible assets, you must work with a broker or seller to facilitate their purchase. These sellers usually charge additional fees as flat rates or percentages of the purchase price. Because each broker charges a different amount, it’s difficult to pinpoint a specific number.

Storage Fees

Because gold, silver, and other precious metals are physical assets, they must be stored somewhere. The IRS requires storing all precious metals in an approved depository or vault. Most depositories charge yearly fees that average between $175 and $225.

Maintenance Fees

Many IRA management companies charge some form of administration fee, and Gold IRA companies aren’t different. Gold IRAs routinely charge maintenance fees for flat rates, sometimes up to $300 annually. The first year’s fees usually get rolled into your account setup fee at a discount. The maintenance fee covers all account administrative actions, like processing your statements and maintaining your account’s records.

Miscellaneous Fees

Unfortunately, those aren’t the only fees with a Gold IRA. You may also need to pay wire transfer fees. Payment of these fees may come due if you need your gold IRA custodian to wire funds to you or if you need to wire to a coin or bullion dealer or depository. Wire transfer fees aren’t hefty, but an average of $25 per transaction may add up. In most cases, the custodian will disclose these fees and their amounts in the new account paperwork.

Depending on your depository, you may need to pay a separate fee for liability insurance, which protects your investment should something happen to the metals in your IRA. Most of the time, this fee gets lumped in with your storage fees.

Open Your Own Gold IRA

Opening your Gold IRA can be a significant investment, but it diversifies your portfolio and helps hedge against inflation. If you’ve never considered a Gold IRA, take some time to research how it works and discuss the possibility with a trusted financial advisor who can help explain the cost of a Gold IRA.

Using your existing retirement funds to help finance the Gold IRA is simple. Our team can help you roll over your current 401(k) or IRA to help preserve tax advantages. To learn more about how the process works, download your free gold investment guide today.

Tags: cost of gold ira, how much does it cost to start a gold ira