How to Choose the Best Gold IRA Company

While investors have plenty of options when seeking a Gold IRA company, choosing the right one can make a big difference in the experience. You want your Gold IRA company to provide the answers you need, be responsive to your concerns, and showcase its knowledge and experience in the industry.

Advantage Gold focuses on more than just explaining what a Gold IRA is. Our team can help you decide which specific gold coins or other precious metals make the most sense for your portfolio. We’ll also help you find the gold IRA custodian that best meets your needs.

If you’re unsure what to look for when selecting a Gold IRA company to steward your investments, this guide is for you.

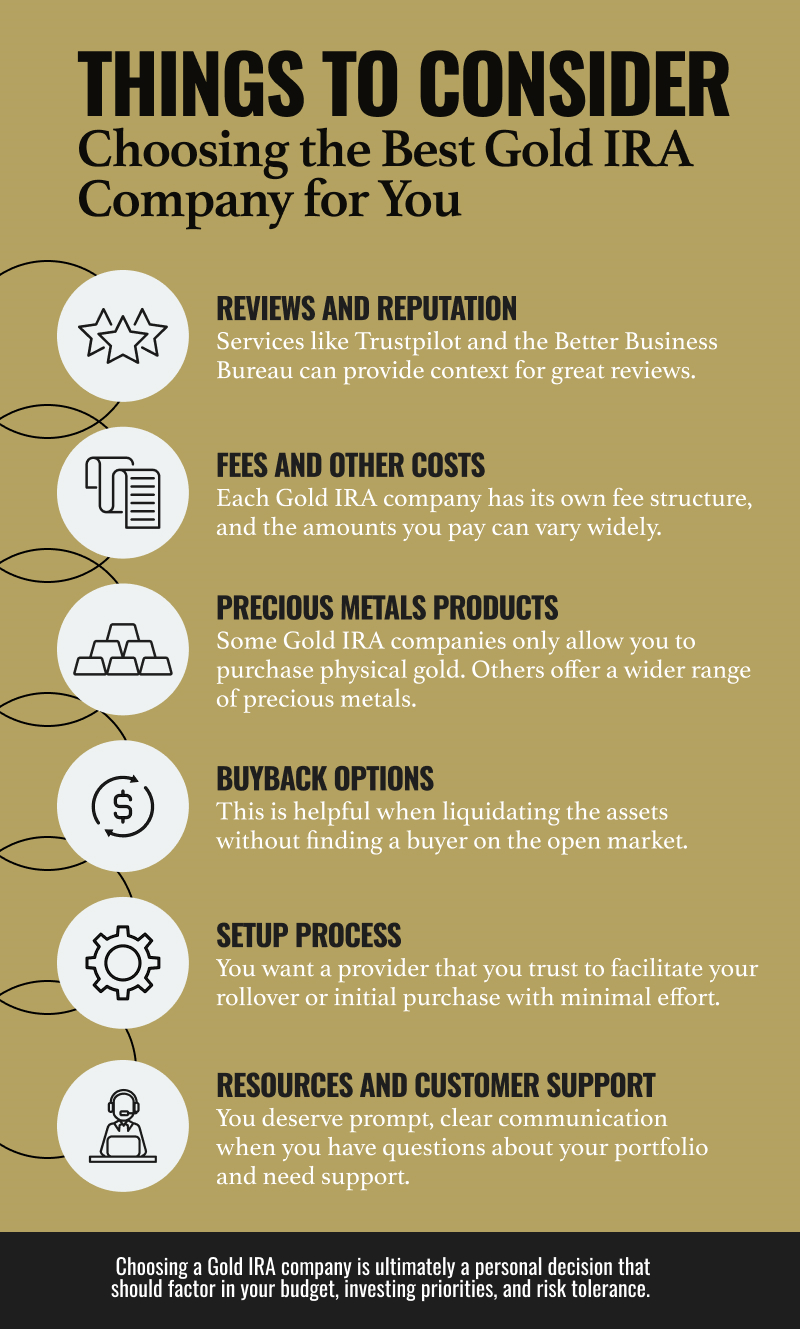

Things to Consider When Choosing the Best Gold IRA Company for You

If you’ve already decided to invest in a Gold IRA, there’s a good chance you have a handle on how the process should go, but there’s still a lot of information you need to digest to help choose your Gold IRA company. Consider the following details as you shop for a partner, and don’t be afraid to ask detailed questions if you have any lingering hesitation about them:

- Reviews and reputation

- Fees and other costs

- Precious metals offered

- Buyback options

- The company’s setup process

- Resources and customer support

Reviews and Reputation

One of the best ways to gauge the trustworthiness of a Gold IRA company is to seek out reviews from real investors. But don’t just seek out positive mentions. Look for negative reviews of the company to see if they raise any red flags. Services like Trustpilot and the Better Business Bureau can provide context for great reviews. Advantage Gold, for example, boasts an excellent five-star rating based on more than 1,500 reviews.

Other resources you can use to research Gold IRA companies include financial advice forums like NerdWallet or Forbes Advisor, which perform extensive research into the reputation and processes of each one to pass their recommendations on to you.

Fees and Other Costs

All Gold IRAs include fees. But how your Gold IRA portrays those fees is as vital as the costs themselves. Each Gold IRA company has its own fee structure, and the amounts you pay can vary widely. Some companies may offer lower setup fees but higher annual ones, or vice versa. Others might offer scaled fee structures, through which the costs increase as the value of your investment grows.

High fees can eat into your investment returns over time, so it’s crucial to understand the costs involved before you choose a company. One with lower fees might be a better choice for smaller investments, but a scaled fee structure might be more cost-effective for larger accounts.

At Advantage Gold, we do not hide our fees. As an investor, you can ask any question about what you owe when opening your IRA, and we lay out the costs on our website.

Precious Metals Products

Some Gold IRA companies only allow you to purchase physical gold. Others, like Advantage Gold, offer a fuller assortment of potential investments. Gold, silver, palladium, and platinum coins are available for purchase through our partners.

Why is such a diverse product lineup significant? Because Gold IRAs are self-directed investment portfolios, you should enjoy maximum flexibility when purchasing IRS-approved precious metals.

Buyback Options

Eventually, you may want to liquidate your Gold IRA to fund your retirement or move those funds back into a traditional IRA. Buyback options refer to a provision in which your Gold IRA company agrees to buy back the precious metals from an investor at the current market price. This is helpful when liquidating the assets without finding a buyer on the open market.

Why are buyback options a critical consideration for investors? Finding a buyer for your gold might be difficult when you need to move quickly. Robust buyback options allow you to sell your gold to the Gold IRA company at the current spot price, minus any fees or charges. Advantage Gold has a simple buyback process: We won’t turn customers away.

Setup Process

A simple Gold IRA setup process makes a difference, especially given how complex most investing can be. Luckily, Advantage Gold can explain how a Gold IRA works. When you apply for and open an account, you want to trust that your chosen provider can facilitate your rollover or initial purchase with minimal effort.

Resources and Customer Support

You deserve prompt, clear communication when you have questions about your portfolio, purchased gold assets, custodian, fees, or other details. Like many of the most reputable Gold IRA firms, Advantage Gold provides resources to help you understand your portfolio—including a detailed guide to getting started, lists of IRA-eligible precious metals, and more. But you also need hands-on communication and customer support.

Advantage Gold’s knowledgeable account representatives are available to facilitate communication between you and your gold custodian. Don’t settle for less just because the fees may be cheaper. Ensure a smooth transition by working with our dedicated people.

Is Advantage Gold the Best Gold IRA Company for You?

Choosing a Gold IRA company is ultimately a personal decision that should factor in your budget, investing priorities, and risk tolerance. What makes the most sense for you might not fit someone else well.

Advantage Gold is one of the most trusted brands in Gold IRAs and self-directed investment. Our customer service team can answer any question, and our account executives are standing by to guide you to a Gold IRA solution that works for you.

Download our free Gold IRA guide today.

Tags: best gold ira companies, best gold ira company, gold ira companies